Bank of America, the nation’s largest retail banking company, announced on August 23 that it’s cutting its ties to the nation’s top two money transmitters, Minneapolis-based MoneyGram International and Western Union. This comes as Somali Financial Services Association of North America (SFSA), a union of a dozen or so small money transmitters are making an eleventh-hour attempt to prevent local banks from closing their accounts.

On Monday, local banks including Minneapolis-based TCF, U.S bank and Iowa-based Wells Fargo, announced they will close accounts used by Somali money wiring companies due to stiff regulations by the federal government. The move could unravel the multi-million dollar money wiring business in Minnesota and might put millions of people in Africa and elsewhere whose relatives live in the state in financial crisis.

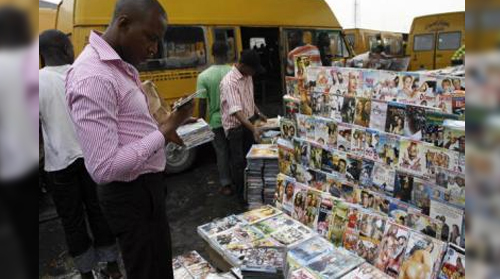

The money wiring companies, locally known as “Hawalas”, utilize traditional methods to transfer money around the world. Thousands of immigrants in the U.S use this system.

Money wiring companies say that U.S Bank and Wells Fargo have closed their accounts for months or even years in some cases. But TCF, which seems to have endured the ever-increasing rigid rules put forward by the federal government over terrorism and money laundering concerns, sent a notice to at least half a dozen Hawalas informing them that their accounts will be closed by September 14.

Representatives from the Hawalas met with representatives from the offices of senators Mark Dayton (D-MN) and Norm Coleman (R-MN) Monday in hopes that the two senators can come to their aid. They are also planning to meet with the state attorney general’s office soon, but it’s not clear what state officials and senators can do immediately.

One of the Hawala operators who attended those meetings and didn’t wanted to be identified because of the ongoing efforts, said that a major concern for the federal authorities is that they are unable to track money wired from the U.S. to the United Arab Emirates, the global financial headquarters of almost all Hawalas where the money is first sent to before distributing it throughout the world.

Financial institutions, including Bank of America, are citing new – and costly- federal regulations that require surgical tracking of accounts owned by money wiring companies. Costs associated with doing such precise work, banks argue, are just not worth it.

A TCF bank notice sent to SFSA member reasoned the closure of the account with “substantial federal regulations” and “costs and risks” that the bank would simply not be able to handle. It did, however, apologize for the inconvenience.

But Garad Nor, who chairs SFSA, says what they are doing is not only a business, but “a matter of life and death.”

“We serve as a local bank in Somalia. We transmit monthly remittances to destitute and, at times, very ill people whose generous relatives live here in Minnesota,” he said. “If we fail to do that by September 14 (the date TCF said it would close accounts) we can expect human catastrophe in East Africa.”

SFSA sends an estimated $25 million a month to East Africa, according to Nor.

Nor says that his group is exploring “legal ways” to send cash to their customers around the world if the banks insist in severing their relationship with his group.

Industry experts say if the stalemate isn’t broken one way or another, it’s likely to encourage black market dealers to capture the moment and start their own off-the-record, below-the-radar money wiring operations.

“Once legal doors are shut, people will always find illegal ways to send their remittances to their families,” says Faisal Mohamud, an industry expert who consults with money wiring companies.

That scenario, experts concur, poses a greater security risk to the U.S.

Since all SFSA members are licensed and bonded, Mohamud argues that the federal government should pressure private banks to work with them to avert illegal activities.

About 40 percent of Somalia’s Gross Domestic Product (GDP) stems from remittances sent by Diaspora communities, according to Mohamud.

Nor, the SFSA chair, says that his group’s short-term goal is to try to maintain accounts with local banks until a long-term solution is reached.

That long-term solution includes modifying federal regulations in a way that is transparent, yet conducive to the operations of money transmitters.

“We complied with state and federal regulations. We created jobs. It’s time for the feds to work with us.” said Nor.

About Abdirahman Aynte

Abdi Aynte was a news reporter for Mshale in his early journalism years. After a stint at Mshale, he moved on to the BBC, Voice of America and eventually relocated to Doha to join Al Jazeera. After leaving Al Jazeera, Aynte moved back to his homeland of Somalia to become the first Director of newly formed non-partisan Heritage Institute for Policy Studies (HIPS).